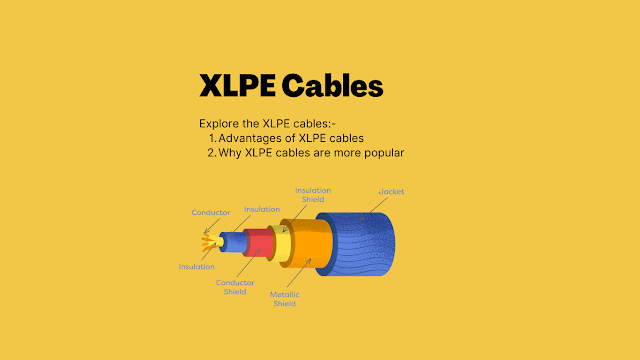

XLPE Cables Applications and Advantages

· Why is XLPE cables are Cross-Linked? In XLPE insulation cables the rubber is vulcanized with addition of Small quantities of chemical additives. This will help to rearrange the molecular structure into a lattice this process will hinders the movement of molecules in the presence of heat. XLPE cable is insulated with hydronic tubing made of cross-linked polyethylene plastic (XLPE). The XLPE insulation has a three-dimensional bond within the plastic. The insulation is a thermoset, zero halogen insulation that provides flame retardant properties. It is strong, durable, and temperature conducting. This process of vulcanization is being carried out to increase the stability of the XLPE cables even at high temperatures. This process of Cross-linking polyethylene also improves current carrying capacity i.e. rating of XLPE in order to withstand higher short circuits and under normal load conditions. By this XLPE insulation, the problem...